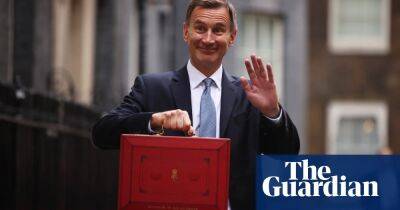

Jeremy Hunt battling to justify pensions giveaway to the top 1%

Jeremy Hunt is battling to justify his budget pensions giveaway to the 1% after two leading economic thinktanks warned it could have no impact on NHS retention while opening up a vast new loophole for tax avoidance.

The Institute for Fiscal Studies and the Resolution Foundation both said it was doubtful the £1bn tax break would meet the chancellor’s stated goal of retaining more senior doctors in the workforce, and could allow wealthy individuals to avoid inheritance tax.

Keir Starmer, the leader of the Labour party, renewed his attack on the surprise decision at the heart of the chancellor’s budget, promising to reverse it if his party won the next election. Starmer has said Labour would address the staffing crunch in the NHS by limiting the tax break to doctors only, rather than extending it to all high earners.

He said: “It’s very easy to bring in a tailor-made approach just for doctors; it was done for judges just a few years ago. And so the idea that a billion pound giveaway to the richest 1% was necessary just falls apart the moment it is examined.”

On a day of heavy criticism over the move, the chancellor insisted his budget had not served as a giveaway for the rich.

Billions of pounds would help people in the cost of living crisis, Hunt said, adding: “I think it is a rather bizarre thing to say that when this is a set of measures that means in two weeks’ time we are going to be spending a total of £94bn this year.”

Government ministers and backbench Conservative MPs pointed out that Labour had also promised to remove the cap for doctors, while arguing that Hunt’s changes were quicker and less bureaucratic than singling out one sector of the economy.

However, Paul Johnson, the director of the IFS, suggested the tax break

Read more on theguardian.com

![Dogecoin [DOGE] exits as Twitter bird makes a comeback](https://fvbb.com/storage/thumbs_400/img/2023/4/6/62642_0hg.jpg)