Biden's student debt forgiveness may be taxed in these five states

Borrowers may have to report forgiven student loan debt as earnings in some states, according to a recent report. ( iStock )

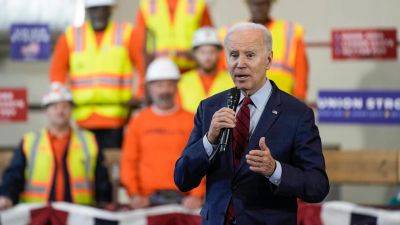

Millions of borrowers may be eligible to receive some student loan forgiveness under President Joe Biden's new income-driven repayment (IDR) plan. Still, according to a recent report, some may face having to pay taxes on these savings.

The Biden administration introduced the Saving on a Valuable Education (SAVE) plan to help student loan borrowers after the Supreme Court's decision to strike down Biden's student loan forgiveness plan.

The new IDR plan would reduce the monthly payment to $0 for borrowers earning $32,800 a year or less, translating to roughly $15 an hour, the White House said in a statement.

Additionally, borrowers with an original balance of $12,000 or less will receive forgiveness of any remaining balance after making 10 years of payments, with the maximum repayment period before forgiveness rising by one year for every additional $1,000 borrowed.

More than 800,000 Americans with student debt who have been in repayment for over 20 years have already started to see those debts canceled, and the administration estimates that over 20 million borrowers could benefit from the SAVE plan.

Although discharged student debt is exempt from federal tax due to the American Rescue Plan Act of 2021, some states may still tax the savings, according to a report by the Tax Foundation.

As of 2023, Indiana, North Carolina and Mississippi have stated that the balance of forgiven student loans will be taxed as income. Taxpayers in Arkansas and Wisconsin may also have to pay taxes on forgiven student loan debt, but these states are currently reviewing their tax laws and have yet to decide.

If you

Read more on foxbusiness.com

foxbusiness.com

foxbusiness.com