US investors want clarity on Biden's vague curbs on China tech

technology sectors which they say are too vague and put the onus of compliance on investors.

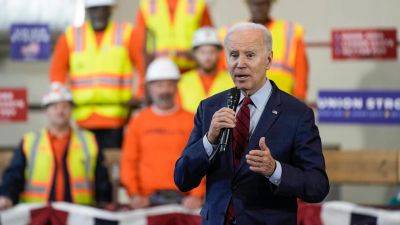

Aiming to protect national security and prevent US capital from aiding China's military, President Joe Biden issued an executive order last month restricting new US investments in sensitive Chinese technologies. The Treasury Department subsequently kicked off a rule-making process to implement the order, and financial firms have been rushing to meet a Sept. 28 to provide input. The rules are expected to be implemented sometime next year.

Elevate Your Tech Prowess with High-Value Skill Courses

Offering CollegeCourseWebsiteNorthwestern UniversityKellogg Post Graduate Certificate in Product ManagementVisitIndian School of BusinessISB Digital TransformationVisitNorthwestern UniversityKellogg Post Graduate Certificate in Digital MarketingVisitIIM LucknowIIML Executive Programme in Data ScienceVisit The proposed rule applies to US persons — including US citizens, residents, businesses and US units of overseas businesses. They must notify the Treasury when making certain investments in China in the semiconductors and microelectronics, artificial intelligence and quantum information technologies sectors, and bans other such investments altogether.

In addition to venture capital and private equity firms, hedge funds, banks and potentially funds that track indexes are likely to be affected by the proposal, which financial industry executives and lawyers complain is broad and ambiguous.

Among their key concerns: how the rules would apply to US persons; which specific Chinese entities would be subject to the restrictions; and better defining a proposed exemption for publicly traded securities.

«The scope is pretty broad,» said Timothy