Climate Week’s biggest news wasn’t part of Climate Week

This week, one of the hallmark events centered on curbing global warming — NYC Climate Week — convened sustainability experts and evangelists from around the world in one place.

The event, which coincides with the United Nations General Assembly, has become a must-attend occasion for people in the field, mixing a festival-like atmosphere with serious talks and panels about how to address what many consider to be the biggest threat facing humanity and the world.

But the major news has occurred outside the event – it’s an optimal time for announcements, protests and new sustainability-related legislation or regulations.

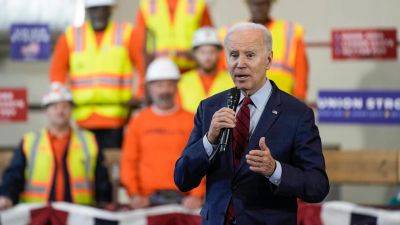

Over the past week, the Securities and Exchange Commission finalized its long-awaited fund names rule, largely an anti-greenwashing regulation focused on sustainable investments. California’s Democratic Gov. Gavin Newsom indicated he will sign climate-disclosure bills that are significantly wider-ranging than similar ones the SEC is expected to pass later this year. President Joe Biden announced a new initiative, American Climate Corps, a program that will train younger people on clean energy and sustainability as well as help create jobs in the field.

Meanwhile, the Taskforce on Nature-related Financial Disclosures issued a set of recommendations for companies on how they let the public and investors know about risks they face related to nature and how they are addressing them.

And in addition to more general protests on Manhattan focused on fossil fuels, demonstrators amassed in front of the offices of BlackRock, Citi and Bank of America.

It could just be serendipity that the SEC passed its updated fund names rule during Climate Week, given the agency’s regulatory agenda and tightly controlled hearings

Read more on investmentnews.com

investmentnews.com

investmentnews.com