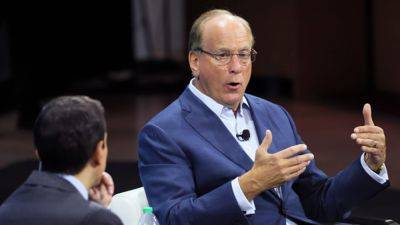

Don’t make fresh investment in ABB, Hitachi, or Siemens now; buy PSU stocks: Dipan Mehta

Dipan Mehta, Director, Elixir Equities, says from a fresh investment angle, avoid ABB, Hitachi, and Siemens. All of these companies’ existing investors may remain invested, but this is not the time to make a fresh investment. These are great stocks to buy when there is a down cycle in the capex cycle and these companies’ earnings are stagnating or even growing negatively, but not at these times when the stocks have rallied as they have. For now, it is a hold for Mehta.

Dipan Mehta further says that investors who are underweight on PSUs banks or defence or engineering companies, this corrective phase is a good opportunity to get at least equal weight.

What do you make of this counter because Ola Electric has been vulnerable to a lot of volatility just in the last couple of weeks. What are you making of this counter and fundamentally, how does this stock look to you?

Dipan Mehta: One cannot really comment exactly why the stock is up 20%. There is no specific fundamental news that has come to my notice at least, except that they are keeping on launching new models and they are addressing their complaint-related issues. But apart from that, I do not know why the stock is up 20%.

But I can say one thing that even at these levels, the stock is extremely expensive and it is very difficult to say when they will recover from that loss situation. In my estimate, they need to go two or three times from these levels before they can break even. I have not done a very deep analysis about it. Given that we are in a corrective

Read more on economictimes.indiatimes.com